– The key steps involved in determining whether a project is worthwhile or not are :

- a) calculate the costs and benefits of the project.

- b) Assess the riskiness of the project.

- c) calculate the cost of capital.

- d) Compute the criteria of merit and judge whether the project is good or bad.

– The important investment criteria are classified into two broad categories :-

- Discounting Criteria :-

– It takes into account of the time value of the money( calculate present value of future worth)

– It has mainly three popular methods:-

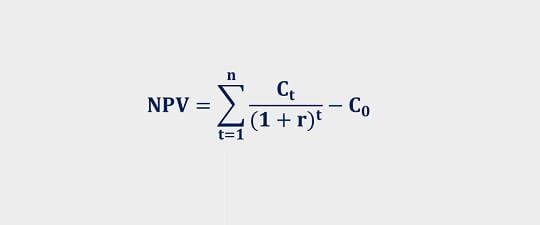

I) NPV

where ,

NPV > 0 , accept project

NPV < 0 , reject project

NPV = 0 , indifferent in decision making.

ii) B/C ratio or profitability index

:max_bytes(150000):strip_icc()/dotdash_final_Profitability_Index_Oct_2020-011-3cc06137c4e24b7dbef3515c7d989bd3.jpg)

– It is the ratio of present worth of benefit stream divided by present worth of cost stream.

Where ,

B/C > 1 , project accepted

B/C < 1 , project rejected

B/C = 1 , Indifferent

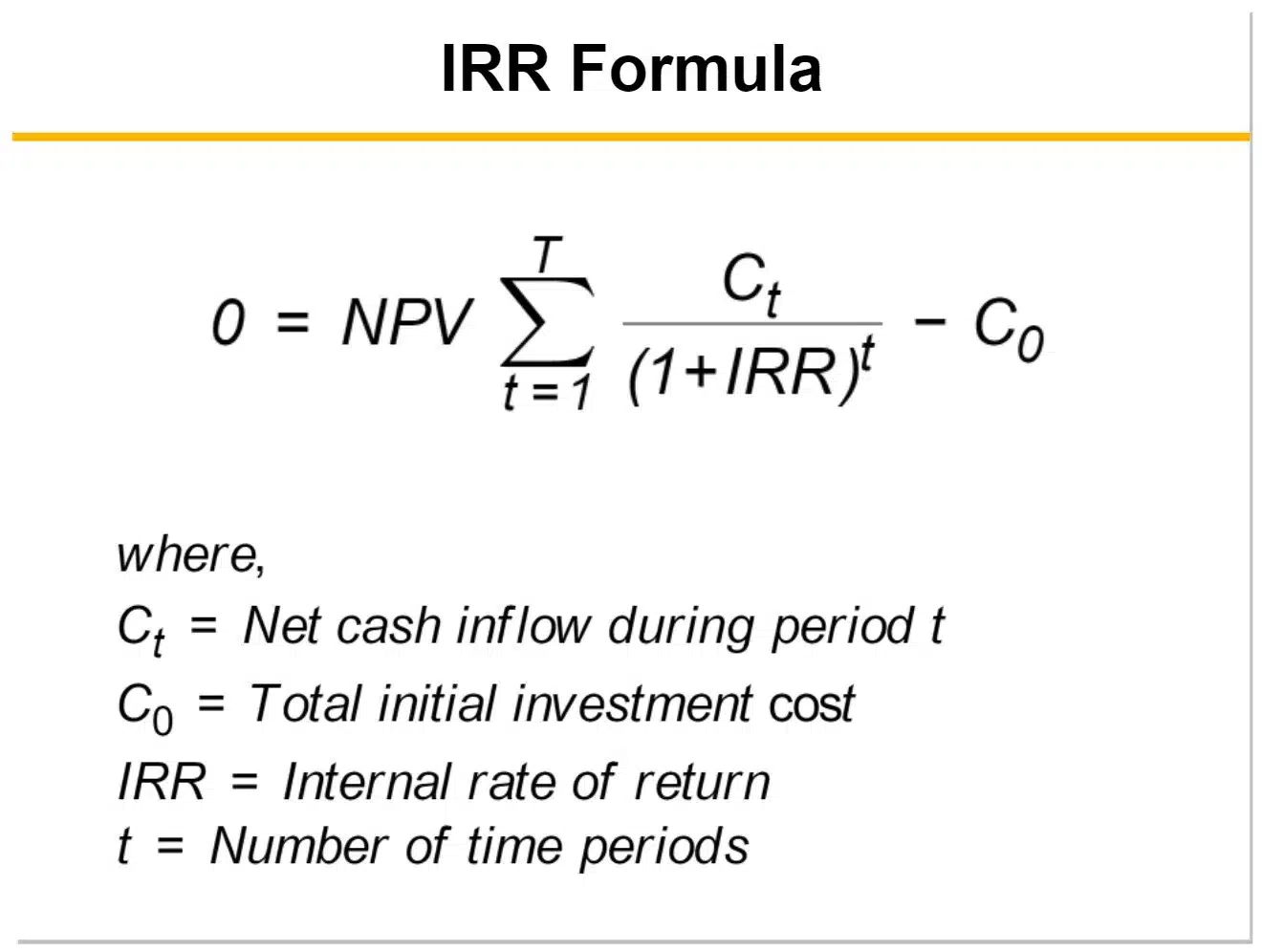

iii) Internal rate of return ( IRR )

– Earning rate of project under evaluation.

– Discount rate at which NPV= 0 .

IRR > cost of capital , accept project.

IRR < Cost of capital , reject project.

- Non – discounting criteria :

I) Simple rate of return :

– Express average annual net income as % of the initial amount invested in the projet.

SRR = Y-D / I

where , Y = Average annual net income

D= Annual depreciation

I= Initial investment

SRR> required rate of return , project accepted.

ii) Pay back period :

– Length of time required to recover the initial investment .

Pay- back period = Initial investment / annual cash flow.

– Shorter the pay back period , project is beneficial , hence accepted.

Advantages :

a) Simple in both concept an evaluation.

b) Rough and ready method for dealing with the risk.

Limitations :

a) Fails to reconsider time value of money.

b) Ignores cash flow beyond pay back period.

Iii) Proceeds per unit of outlay :

Proceeds per unit of outlay = Total value of incremental production/ Total amount of investment

iv) Break even analysis :

– Point at which , company is neither at profit nor at loss.