– The key steps involved in determining whether a project is worthwhile or not are :

a) calculate the costs and benefits of the project.

b) Assess the riskiness of the project.

c) calculate the cost of capital.

d) Compute the criteria of merit and judge whether the project is good or bad.

– The important investment criteria are classified into two broad categories :-

- Discounting Criteria :-

– It takes into account of the time value of the money( calculate present value of future worth)

– It has mainly three popular methods:-

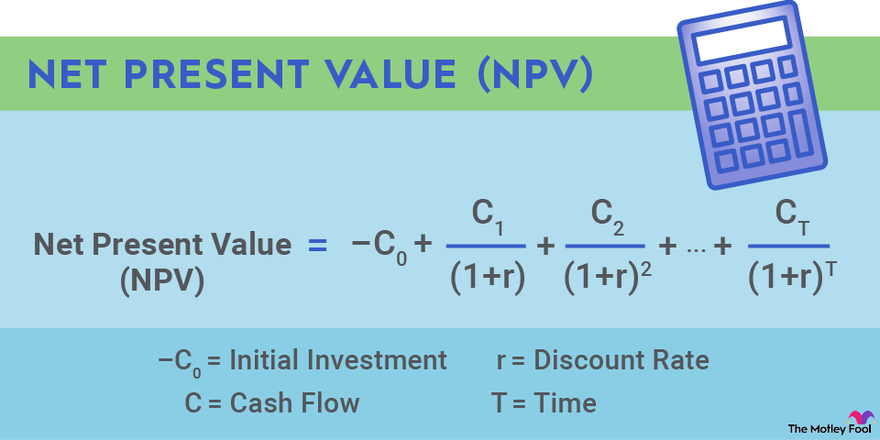

I) NPV

where ,

NPV > 0 , accept project

NPV < 0 , reject project

NPV = 0 , indifferent in decision making.

ii) B/C ratio or profitability index

:max_bytes(150000):strip_icc()/dotdash_final_Profitability_Index_Oct_2020-011-3cc06137c4e24b7dbef3515c7d989bd3.jpg)

– It is the ratio of present worth of benefit stream divided by present worth of cost stream.

Where ,

B/C > 1 , project accepted

B/C < 1 , project rejected

B/C = 1 , Indifferent

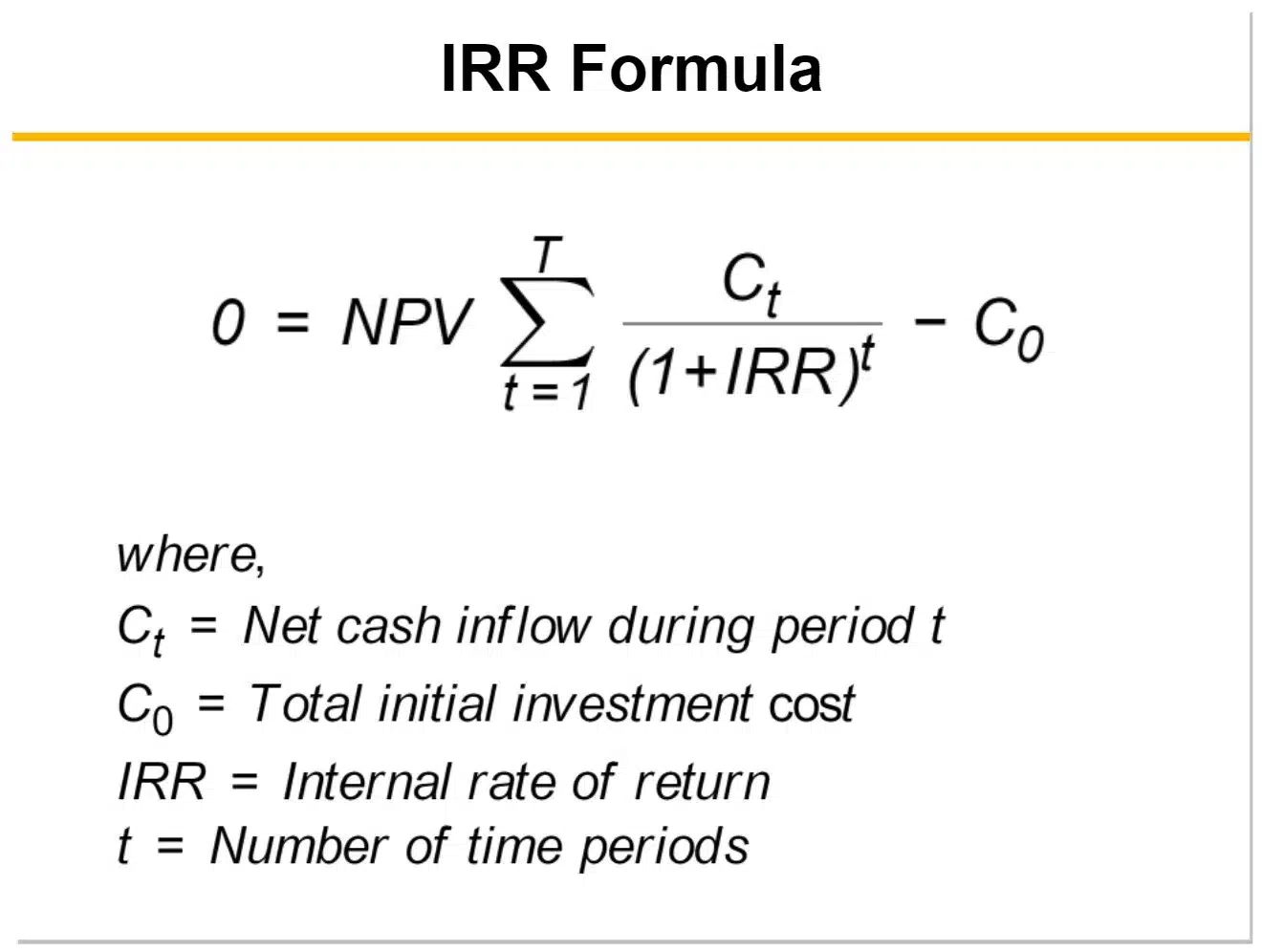

iii) Internal rate of return ( IRR )

– Earning rate of project under evaluation.

– Discount rate at which NPV= 0 .

IRR > cost of capital , accept project.

IRR < Cost of capital , reject project.

2. Non – discounting criteria :

I) Simple rate of return :

– Express average annual net income as % of the initial amount invested in the projet.

SRR = Y-D / I

where , Y = Average annual net income

D= Annual depreciation

I= Initial investment

SRR> required rate of return , project accepted.

ii) Pay back period :

– Length of time required to recover the initial investment .

Pay- back period = Initial investment / annual cash flow.

– Shorter the pay back period , project is beneficial , hence accepted.

Advantages :

a) Simple in both concept an evaluation.

b) Rough and ready method for dealing with the risk.

Limitations :

a) Fails to reconsider time value of money.

b) Ignores cash flow beyond pay back period.

Iii) Proceeds per unit of outlay :

Proceeds per unit of outlay = Total value of incremental production/ Total amount of investment

iv) Break even analysis :

– Point at which , company is neither at profit nor at loss.